Industry News, Coatings

High Performance Pigments Market

Industry News, Coatings

Image: Coatings World

The high performance pigments market is posed for steady growth worldwide, according to the Smithers Rapra report, “The Future of High-Performance Pigments to 2021.” Analysts anticipate a global volume market of 178,844 tons in 2016, with an overall value of $4.76 billion. Across the next five years, Smithers Rapra predicts the market for high performance pigments (HPP) will accelerate steadily at a compound annual growth rate (CAGR) of 3 percent, reaching 206,921 tons in 2021 – at this time world market value will be $5.49 billion.

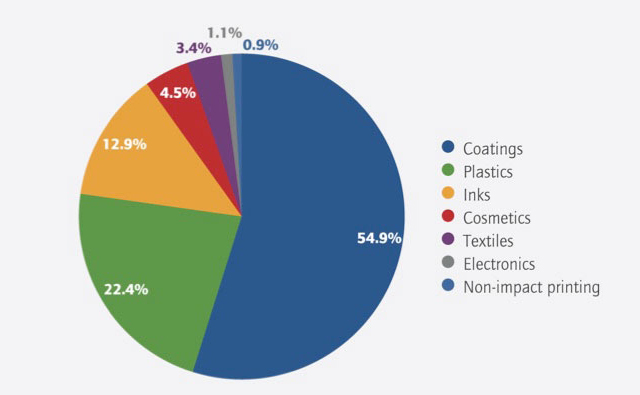

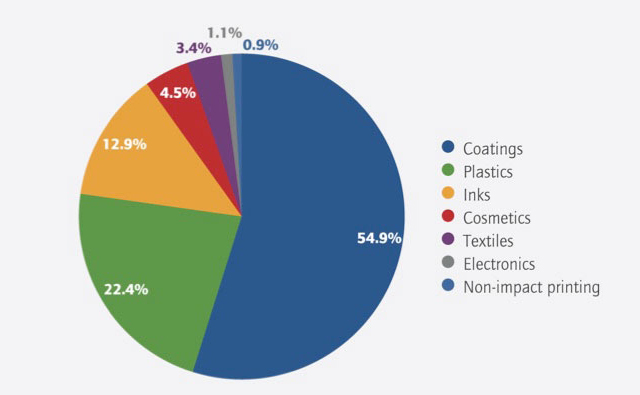

According to the Smithers Rapra report, with a 54 percent market share, coatings remain the most significant end-use for HPPs, followed by plastics, inks and cosmetics, respectively. The fastest developing end-use segment is textiles, although it will remain at approximately 2 percent of global consumption across the Smithers study period. In terms of volume consumption, metallic pigments comprise 43 percent of the 2016 market – with consumption pronounced particularly in Europe – followed by pearlescent and organic HPPs.

The market is evolving against a backdrop of dynamics, some of which are common to pigment supply industry worldwide, and some that are unique to the high-performance segment.

Smithers Rapra’s analysis identifies the following as the leading six across the next five years:

Through the years 2016-2021 there will be a shift towards greater restriction in developing economies. This will be spearheaded by initiates like the World Health Organization’s International Lead Poisoning Prevention Week, and will lead to further market penetration of organic high-performance yellows and oranges and bismuth vanadate.

More sustainable HPPs are a future growth area, tracking wider trends in the chemicals sector. In particular this will see the evolution of more performance pigments whose production involve low or very low emissions of volatile organic compounds (VOCs) – a step supported by new regulatory programs.

The reduction of VOC emissions is being achieved by moving to waterborne coatings and powder coatings. This requires different pigment formulations – especially dispersion technologies – from those appropriate for solvent-borne applications, and requires new investment in many cases.

As supply of these pigment intermediates constricts, upward pressure on pigment prices is a possibility. Simultaneously pigment and end users are working on raw material cost reduction programs, which provides a business opportunity for HPP manufacturers if they can be competitive on the pricing of their products. Use of aluminium-based pigment will also feel the effect of a price increase, as China moves to end its policy of subsidizing smelting of this metal.

Consumer preferences: As demand from developing world states booms, global pigment supply is having to align with consumer inclinations in these markets. In the important automotive segment, for example, there is a need to respond to the widespread preference for white vehicles, with red pigment products also forecast to increase their relative share. At the same time there will be a move away from what are regarded as harsh synthetic products to pigments that deliver softer, more natural colour effects.

HPP manufacturers Coatings World interviewed reported high rates of growth. “The market for high performance and special effect pigments in particular is growing at the highest rate within the pigment market,” said Jens Reininger, head of strategic marketing, Clariant Plastics & Coatings. “Growth in emerging countries in Asia due to lead chromate replacement is contributing along with the growth of automotive and 3C coatings sectors where HPP and special effect pigments have a major use. Also having a positive impact is the current color trend in decorative coatings which creates in the chromatic sector a need for high performance pigments in the red, pink and violet color indices.“

Lansco Colors reported that sales of high performance and special effect pigments have grown with double digit increases year over year due to its success at bringing customers high performance pigments at fair prices. “Lansco Colors was the leader in bringing alternatives to previously patent protected products and we have grown to a market leading position for these pigments,” said Frank Lavieri, executive VP an general manager, Lansco Colors.

“While we have to recognize shrinkage in the overall pigment market, mainly driven by the ink industry, Trust Chem is benefitting from an increase on the high performance pigments side, said Falko Orlowski – executive VP Trust Chem USA. “Manufacturers in Asia, Europe and the Americas are fighting for market share, which results in lower cost for high performance and effect pigments. As a result, lower cost level HPPs are replacing low and medium performance pigments for many applications.”

The market has shown some pockets of improvement during calendar 2016. “Volumes are strong, prices have eroded in some markets due to competition and/or currency swings,” said Ron Levi, president, Bruchsaler Farbenfabrik GmbH & Co. KG. Bruchsal, Germany. “Our marketing presence and sales have grown in India and southeastern Asia as a whole. We have not established a plant in the region, growth has been attained via local stocks and sales organizations.”

The Asia region – particularly China and India – continues to drive growth for the HPP industry.

“Growth of high performance pigments is over-proportionally coming from countries within the Asia region,” said Dr. Stefan Ohren, head of product management High Performance Polycyclic Pigments, Clariant Plastics & Coatings. “India is, for example, growing much faster than other markets. Clariant Plastics & Coatings has long had a well-established position in India. Our Marketing & Sales Organization, as well as the location of pigment product plants in both Roha and Cuddalore and dispersion plants in Roha and Nagda, are well-positioned to serve many countries in the Asia region.”

“The manufacturing of HPPs has been concentrated in either India or China for a considerable number of years,“ noted Robert Poemer, business unit leader, Heucotech Ltd. “In these countries there are both world-class suppliers as well as second tier suppliers. The second tier suppliers produce products that can be used in some marginal applications and also to drive the pricing down on the world-class suppliers.“

Heubach Colour has been in operation in the Gujarat province of India. “We produce a wide variety of organic piments in our facilities including phthalos, indanthrones, quinacridones, DPP and benzimidazolens,“ Poemer added. “Our facilities are 100 percent owned and operated by the Heubach Group. Overall we are seeing an increasing demand of higher quality products also in the emerging markets.“

India is increasing its production capacities for HPPs, but not at the same rate as China, according to Orlowski. “As a Chinese based manufacturer, Trust Chem has a solid footprint in manufacturing and sales in the Asian Pacific region, while also having significant sales in the Indian market. The North American and European markets are still the most significant markets for HPP’s globally.”

HPP manufacturers are constantly being challenged by their customers to develop products that meet increasingly demanding performance requirements. As a result HPP producer are launching products featuring excellent durability, color strength, dispersibility in a range of resin systems and environmental compliance.

Clariant offers quinacridone pigments based on renewable raw materials as part of its commitment to sustainability. “As an example we promote our ‘Pink going Green’ as Clariant uses renewable raw materials to create bio-based high performance quinacridone pigments for automotive, industrial and decorative coatings applications,” said Dr. Stefan Ohren, head of Product Management High Performance Polycyclic Pigments, Clariant Plastics & Coatings.

“Hostaperm Pink E (Pigment Red 122), one of Clariant’s most important polycyclic pigments based on renewable bio-succinic acid, represents Clariant’s switch to renewable raw material without changes in the product quality and the guaranteed specification.”

Heubach Colour in India has recently commissioned a facility for the manufacture of Indanthrone Blue Crude (PB60). “Heubach is the only company that controls the manufacture of Indanthrone Blue from the manufacture of the crude through the final manufacture of a product that is widely used in the automotive OEM and refinish areas,“ said Poemer. “As a result of this investment, we are introducing three new shades: MLB3RHN, MLB3RH and MLB3RXH. Furthermore, Benzimidazolone Pigments Yellow 151 and 154 has been introduced as high quality Yellows for the demanding industrial coatings application and the automotive segment. We launched the VD 2108, a PY.184 with high color strength for the coatings industry (decorative, industrial, automotive) and Heucodur 2550, a high strength Chrome Rutile Yellow. We also have introduced a zinc-free anticorrosive pigment providing a not yet seen corrosion protection performance in a broad range of application.”

Cabot offers three families of products – carbon blacks, primarily used for their color, fumed silica, used for rheology control, free flow and mechanical properties, and fumed silica dispersions for transparency. “The market for Cabot’s premium EMPEROR high color carbon black continues to be robust and growing as a result of strong demand from the automotive industry,” said Adam B. King, global marketing communications manager, Performance Chemicals, Cabot Corp.

With the opening of its new Quinacridone plant, Trust Chem is working on a new range of PR202 products and improved PV19 and PR122 versions. “We further continue to focus on cost reduction through technical improvement and production streamlining,” said Li Wu, global technical director, Trust Chem. “Trust Chem is pushing more and more HPPs into the food packaging market.” Lansco Colors has brought several new high performance pigments to market recently. “Lansco 1667 Opaque Orange 67 is one of the most opaque organic pigments on the market and is finding wide acceptance in the industrial coatings market where its properties are valued,” said Lavieri. “It is a bright clean orange with excellent value in use.”

Bruchsaler Farbenfabrik continues to focus on bismuth vanadates and environmentally friendly pigment blends based on this chemistry.

“Easy dispersing and zinc free versions of our pigments are just two of the technologies we recently introduced,” said Levi. “These pigments find their use in high performance coatings, plastics, building materials and specialty inks.