Industry News, Adhesives & Sealants & Tackifiers

Pressure-Sensitive Adhesives Market to Cross $11 Billion by 2024

Industry News, Adhesives & Sealants & Tackifiers

The pressure-sensitive adhesives (PSAs) market is expected to surpass $11 billion by 2024, according to a research report by Global Market Insights Inc. The growth is due to increasing usage in the automotive and transportation industry, as PSAs are finding use as alternatives to bolts, clips, and rivets, thus improving the speed and ease of assembly. PSA tapes are used to reduce weight, advance performance, improve aesthetics, and save time and money.

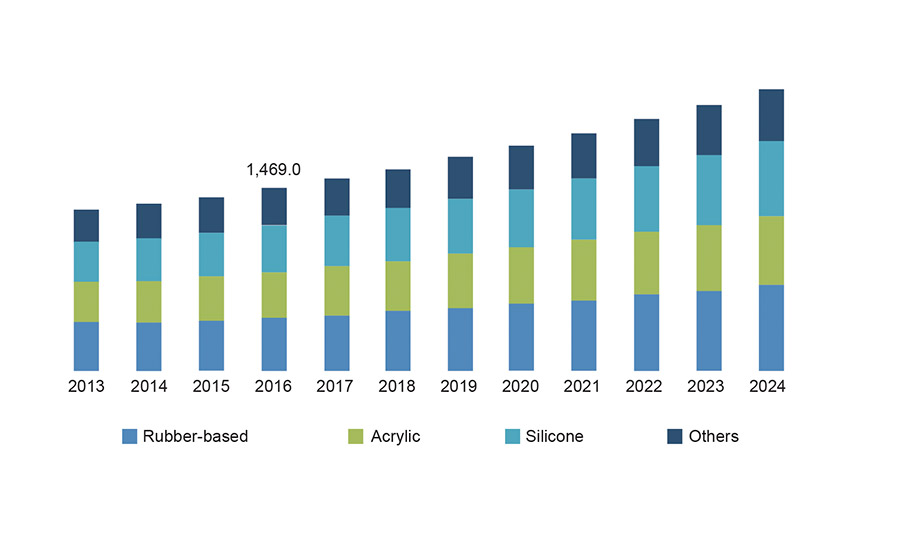

Figure 1. Pressure-sensitive adhesives market size by product, 2013-2024 ($ million). ©ASI

Increasing raw material prices for natural and synthetic rubber, acrylate monomers, organic and inorganic chemicals used in the production of PSA tapes can be considered as a restraint for the PSAs market, due to pricing and availability factors. Most of these raw materials are derived from petroleum derivatives, thus susceptible to fluctuations in oil prices.

The PSAs market is classified based on technology as water based, solvent based, hot melt, and UV cured. In terms of volume, the water-based segment holds a maximum share in the product market and is projected to grow at a significant compound annual growth rate (CAGR) to surpass $4 billion by the end of 2024. The solvent-based segment is expected to grow at the highest CAGR of over 5.5% in the upcoming years.

In terms of products, the PSAs market is bifurcated into silicone, acrylic, rubber based, and others (e.g., polyurethanes and EVAs). The silicone pressure-sensitive adhesive market is projected to grow at a strong rate due to the product’s increasing use in medical applications and personal garments. The acrylic segment is expected to showcase moderate growth and surpass $2.5 billion by 2024.

Applications for pressure-sensitive adhesives are segmented into: films and laminates, graphics, labels, tapes, and others. The “others” segment consists of dental adhesives, automotive trims, etc. Development in the food and beverage industry, as well as increasing packed food consumption, will reportedly have a positive influence on the labels segment; it is the fastest-growing segment and will exhibit strong growth with a CAGR of over 6% in the forecast period.

End-user markets are segmented as healthcare and medical, laminates and electronics, packaging, transportation and automotive, building and construction, food and beverages, and others. The packaging segment will reportedly hold the highest market share [em dash] close to 30% by 2024. The electronics and laminates segment is expected to grow at the highest CAGR—to surpass $3.3 billion by the end of the forecast period.

Asia-Pacific held a significant share of the market in 2016; the region is projected to surpass $4.5 billion by the end of the forecast period. In terms of volume, Asia-Pacific will hold the largest share by 2024, due to rising industrial activities and development in the packaging, electronics, and food and beverages industries. The European market will showcase growth at a sluggish rate in the forecast period, due to the developed market in this region paired with the stringent governmental norms.