Coatings

Industrial Coatings Market

Coatings

Industrial coatings encompass a large and varied market. Typically industrial coatings are used to coat high-value assets that need to withstand harsh environmental conditions. Industrial coatings are used in onshore oil and gas, commercial architecture and industrial maintenance applications.

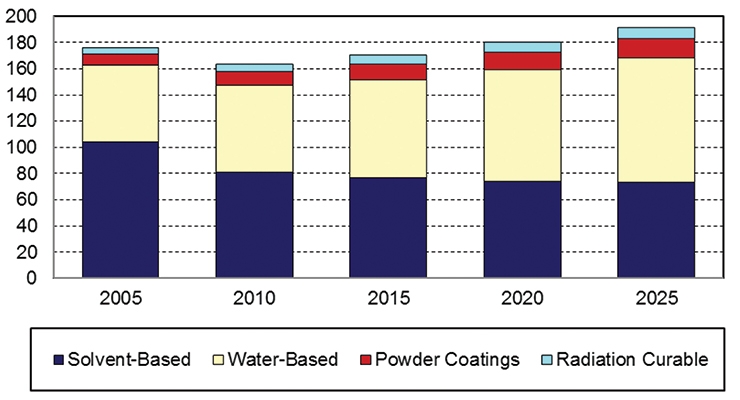

Historically, solvent-based coatings have maintained the largest share of protective and specialty coatings. However, according to a new study from the Freedonia Group, Protective & Specialty Coatings Market in the U.S., solvent-based coatings are projected to be surpassed by water-based coatings by 2020 as regulatory concerns continue to impact the protective and specialty market. Solvents will continue to lose share to other formulations, with trends favoring the use of water-based, high-solids and other coatings, which have lower or no VOC emissions.

Figure 1. Protective & Specialty Coatings Demand by Formulation, 2005-2025 (million gallons), Source: The Freedonia Group ©Coatingworld

According to the study, demand for water-based coatings in the protective and specialty segment is predicted to expand at an annual rate of 2.5 percent to 85 million gallons in 2020, supplanting solventborne coatings as the market leader. Water-based coatings are also gaining a foothold in protective marine coatings as several worldwide treaties and U.S. regulations have put stringent limits on emissions produced by marine coatings. Waterborne coatings provide good adhesion to the market’s primary substrate – metal – and offer solid resistance to weather, chemicals and other harsh conditions in which all varieties of watercraft are exposed.

“Environmental regulations will continue to tighten in the years ahead as governments around the world seek to reduce resource consumption, emissions, and exposure to chemicals of concern,” said Shelley Bausch, PPG vice president, Global Industrial Coatings. “While the VOC tax in China and REACH regulations in Europe receive significant attention, all layers of government, including local communities, are getting involved.”

“For many of our customers, though, regulatory compliance is only part of the equation,” Bausch continued. “They view themselves as good stewards of the environment and take a more holistic approach to sustainability that includes issues like eliminating heavy metals, reducing energy usage and extending the lifespan of their products. Every day, we help customers shift from legacy solventborne coatings to a range of more environmentally-friendly solutions. Depending on the application, the best solution could be a high-solid, low-VOC solvent-based coating, a waterborne coating, a powder coating or electrocwoat. Often, a system approach across layers yields the best outcome. We expect these conversions to continue, if not accelerate, in the year ahead. Legislation around the globe will support this trend, as will increasing focus from investors, NGOs, local communities, end consumers, and our customers themselves.”

“We continue to see environmental legislation affecting the technologies we offer. VOC-driven legislation globally and more chemical restrictions affect how we can formulate industrial coatings,” said David Calabra, General Industrial global product director, Sherwin-Williams Product Finishes. “Clearly VOC reduction has led to powder technology replacing much of the liquid baking enamel coatings. Water-based coatings continue to grow with legislation in China encouraging these products. Water-based acrylics and alkyds are needed, as are water-based urethanes supported by robust water-based epoxy primers. In the end it is important to offer a full line of water-based products as alternatives to solventborne platforms.”

Europe has been a leader in adopting environmental regulations. “There is a trend for many years in Europe to move away from low volume solids products and introducing higher volume solids products as well as waterborne systems,” said Gerard de Vries, business director Protective Coatings North Europe, AkzoNobel. “Depending on the kind of application both technologies can be considered. Alkyds are losing some share in the total product mix although there are still applications where they can and will be used.”

“At Axalta, we don’t wait for regulators to initiate environmentally sustainable coating developments – we’re inspired by our wide range of customers who want to help preserve and enhance the environment for future generations,” said Michael Cash, SVP and president, Industrial Coatings of Axalta. “Our customers help guide us toward innovations like Alesta powder coatings collection for aluminum extrusions, Hydropon, our innovative waterborne coatings for coil and extrusion applications, and Nap-Gard high temp exterior pipeline coatings, which replace solvent borne liquid products. We usually find that our industrial customers are extremely conscious of the environment, and we work closely with our customers to match our product development strategy with their business needs, as well as our joint obligation to sustainability.”

Environmental legislation has been a key driver in different parts of the world in reducing the usage of solvent-based coatings. “The two most common ways to limit impact is via water-based coatings or the increasing use of higher solids coatings with less solvents,” said Klaus Moeller, group vice president, Group Protective Marketing, Hempel A/S. “The coatings industry is, and has been for a while, heavily investing in R&D to develop new and innovative products with less environmental impact.”

According to PPG’s Bausch, global industrial coatings continued a low-single-digit growth trajectory last year, in line with macroeconomic trends. “As you would expect, there was wide variation in performance across segments and geographies. In Asia-Pacific, the automotive, transportation and electronic materials sectors experienced high levels of growth. China’s development continued to drive industrial production in the region while growth rates in India and Southeast Asia were among the fastest in the world.”

“The U.S. and Canadian economies experienced slower construction growth and an overall decline in industrial production. Coatings for building products, as well as automotive builds, were central to regional performance,” Bausch continued. Most segments in Latin America continued to be negatively impacted by Brazil’s economy-wide challenges. A bright spot in the region was the continued growth of automotive production in Mexico. EMEA’s industrial activity showed a modest recovery from recent challenges with particular strength in central and eastern Europe; infrastructure spend in the Middle East remained solid throughout the year.”

The last 12 months have been characterized by challenging market conditions, linked to the price of crude oil. “Although we’ve recently seen prices edge upwards, the industry still faces headwinds and the recovery of the market is still very fragile,” said de Vries. “There is some uncertainty too. There are so many important global events in 2017 important events which could have a considerable impact; such as elections in some key European countries as well the agenda of the newly elected Trump administration. Also, the submission of a Brexit will have its impact in Europe. Overall, demand for coatings solutions continues to be strong given the importance it plays in asset protection and safety. This means investing in maintenance and upkeep to drive operational efficiency.”